Why Yield Bearing Token allow for higher yield

Key Takeaways

Tokenization offers a streamlined and efficient investment process, enabling faster rebalancing, optimal fund allocation, and ultimately better yields compared to traditional account models.

Carrot enhances the user experience by simplifying access to investments, ensuring ease of monitoring, and integrating seamlessly with the DeFi ecosystem.

The platform ensures managed risk through diversification, rapid response to market events, and continuous optimization of asset allocation.

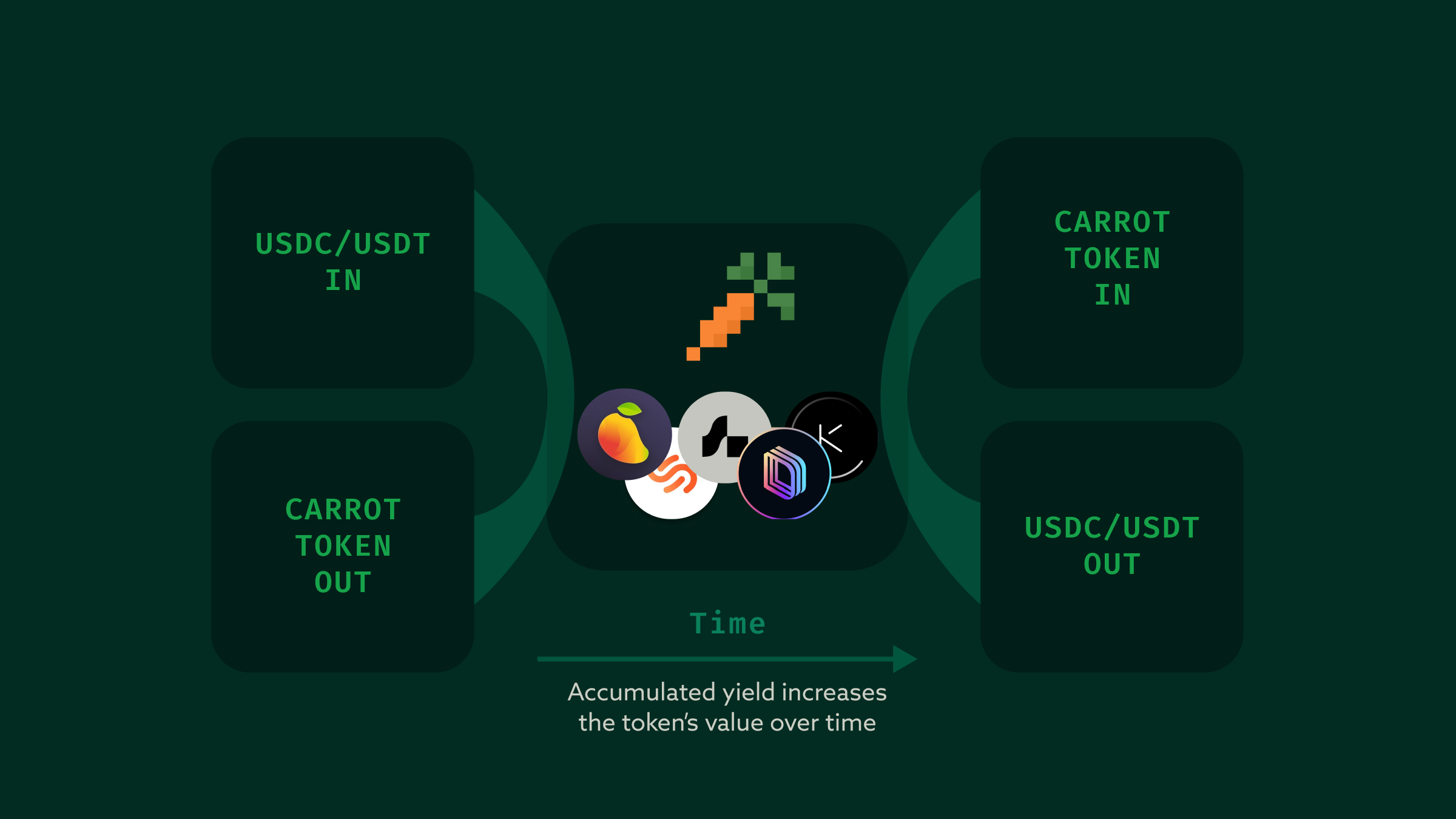

How Carrot’s Tokenization Model Works

Carrot’s tokenization model functions by converting deposited assets into a single token that represents a claim on those assets and any yield generated from them. When you deposit funds, such as stablecoins, into Carrot, they are pooled and strategically allocated across the top 5 DeFi protocols on solana. In return, you receive a Carrot token, which accrues value as yield is generated.

Example: If you deposit 1,000 USDC into Carrot, you’ll receive a corresponding amount of Carrot tokens. As the platform reallocates and optimizes your assets to earn yield, the value of your Carrot tokens increases. Over time, when you redeem these tokens, you’ll receive more USDC than you originally deposited, reflecting the accumulated yield.

How Tokenizing Carrot Creates Higher Yields

Speed and Continuous Optimization

Carrot’s status as a yield-bearing token is key to its ability to rapidly optimize asset allocation. When you deposit assets into Carrot, they are converted into a single token that represents a claim on both the assets and the yield they generate. This tokenization allows Carrot to rebalance assets swiftly in a single transaction, ensuring that your funds are always positioned in the most profitable pools without delays. The yield-bearing nature of the Carrot token ensures that as the platform continuously analyzes and optimizes the market, the value of your token increases, maximizing returns.

Forward-Looking Adaptability

The yield-bearing characteristic of Carrot also enables forward-looking adaptability. Because the yield is embedded in the token itself, Carrot can easily incorporate new token assets and yield sources that align with its criteria. This adaptability keeps Carrot at the forefront of DeFi innovation, ensuring that your yield-bearing token continues to grow in value as new opportunities arise, without exposing you to unnecessary risks.

How Carrot Uniquely Manages Risk

Managed Risk and Stability

As a yield-bearing token, Carrot facilitates effective risk management through diversification and automated responses. The tokenization process allows for a seamless spread of investments across multiple assets, minimizing the impact of any single point of failure. This diversification, combined with Carrot’s ability to programmatically respond to market anomalies, ensures that the stability of your investments is maintained, even in volatile conditions. The yield-bearing nature of Carrot means that your token's value continues to appreciate, even as the platform actively manages and mitigates risks.

Diversification with Multi-Token Strategy

Carrot’s yield-bearing token is also essential to its multi-token diversification strategy. By dividing the investment pool between different stablecoins, such as USDC and USDT, Carrot maximizes yield potential while mitigating risks. The yield generated by these diversified investments is captured in the Carrot token, ensuring that your holdings remain both resilient and profitable, regardless of market fluctuations.

Other Benefits of Carrot as a Yield Bearing Token

Tax Efficiency for Long-Term Holding

The yield-bearing nature of the Carrot token directly influences its tax efficiency. As the token appreciates in value due to the accumulated yield, long-term investors can benefit from potential tax advantages. Depending on your jurisdiction, the appreciation of the Carrot token may be treated as a capital gain, realized only when you sell your position. This makes Carrot an attractive option for those looking to maximize after-tax returns, leveraging the yield-bearing properties of the token for long-term growth.

Ease of Management

Carrot’s yield-bearing token also simplifies the investment experience. With your yield directly reflected in the token’s value, there’s no need to constantly check or manage your investments through third-party dApps. The Carrot token resides in your wallet, offering instant access and visibility, while its yield-bearing nature ensures that your assets are continuously working for you. This seamless integration into the DeFi ecosystem enhances the overall user experience, making it easy to monitor and manage your growing investments.

Conclusion

Carrot simplifies investing by turning your assets into a yield-bearing token that grows over time. This approach allows Carrot to quickly and efficiently optimize your investments, so you don’t have to wait around for rebalancing. By adapting to new opportunities and keeping risks in check, Carrot ensures your investments are always working to their fullest potential.

Risk management is a key part of Carrot’s strategy. The platform diversifies your investments across various assets and adjusts automatically to market changes, keeping things stable even when conditions are unpredictable. The multi-token strategy helps maximize returns while minimizing risk.

Additionally, Carrot offers tax advantages and an easy investment experience. The value of your investments grows directly through the token, reducing the need to manage multiple platforms. Overall, Carrot’s blend of efficiency, adaptability, and user-friendliness makes it a strong choice for both seasoned and new investors looking to simplify and enhance their DeFi experience.