How Carrot’s Automated Rate Maximizer Generates More Yield

Key Takeaways

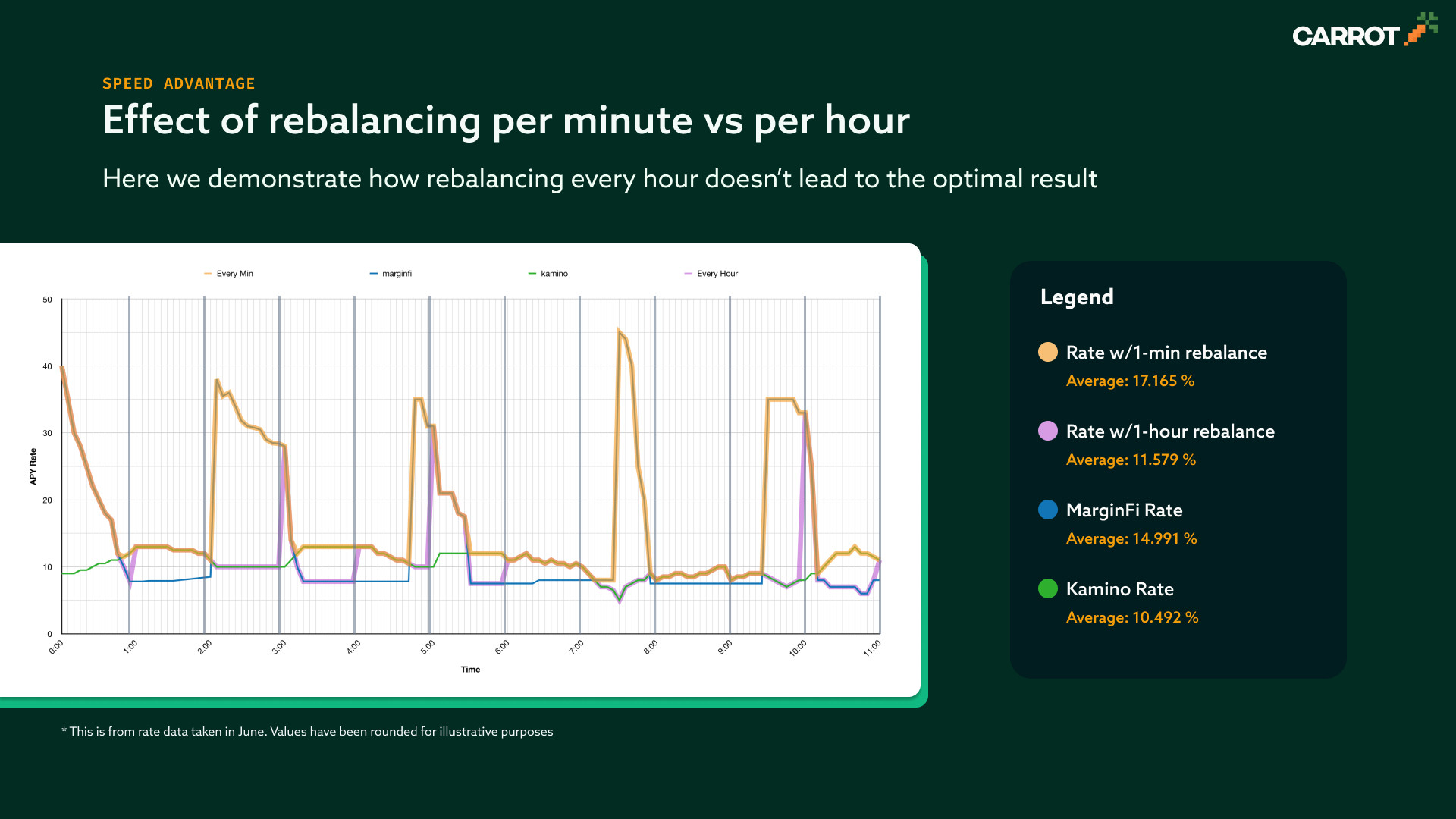

Continual Rebalancing offers superior returns by dynamically adjusting asset allocations as market conditions change, ensuring optimal yield capture compared to hourly rebalancing strategies.

Carrot's Algorithm intelligently scans multiple DeFi protocols in real-time, strategically diversifying investments to maximize returns while minimizing risks, protecting your assets from market volatility.

Efficiency is at the heart of Carrot’s process, rebalancing funds across protocols with a single transaction, reducing both time and transaction costs for users.

Better Yields, Faster: Carrot’s continual rebalancing strategy consistently delivers higher APY, achieving 17.2% on average compared to 11.6% for hourly rebalancing, allowing you to capture fleeting high-yield opportunities without delay.

What is Rebalancing?

Rebalancing in DeFi involves shifting assets or funds across various lending protocols to secure the highest available yield. As yield rates fluctuate across protocols, rebalancing ensures your capital is always placed where it can earn the most, optimizing returns over time. This dynamic strategy plays a crucial role in maximizing gains and minimizing the risks associated with leaving funds in underperforming pools.

Carrot takes the concept of rebalancing to the next level by automating this entire process. Through our continual rebalancing model, Carrot identifies the most profitable yield opportunities across multiple DeFi protocols and swiftly reallocates your assets with a single transaction. By constantly scanning the market for fluctuations, Carrot ensures your funds are never idle in low-yield pools.

How often does Carrot scan the market?

Some might wonder, "Why not manage rebalancing manually?" While it’s certainly possible, manual efforts can be time-consuming and challenging to keep up with, especially given how quickly market conditions change in DeFi. Carrot scans the market frequently and with precision, adjusting allocations to capture yield opportunities as they arise.

By automating this process, Carrot ensures that your assets are continuously optimized. We are constantly scanning the market every second, helping you avoid missed opportunities that might arise from market volatility. In a fast-paced environment like DeFi, even short delays can impact your returns. Carrot simplifies this by handling the rebalancing efficiently, allowing you to benefit from timely adjustments without needing to manage it manually.

Smart Decision Making

At the core of Carrot's platform is its advanced algorithm, which powers its intelligent decision-making process. Carrot doesn’t just chase the highest yield blindly; it strategically diversifies investments across multiple protocols on Solana, weighing yield potential against risk exposure. By leveraging real-time data analytics, Carrot continually evaluates:

Which protocols offer the best yields

Which pools are safe from liquidity risks or fully utilised pools

How market events or shifts in liquidity may affect returns

This approach helps avoid overexposure to any single strategy, reducing the risk of major losses during volatile market conditions. The result is more consistent and sustainable yield generation for users, even as market conditions fluctuate.

Rebalancing Every Hour vs Every Minute

Rebalancing frequency is a crucial factor in maximizing yield. Carrot offers continual rebalancing, meaning that assets are constantly being monitored and reallocated whenever a better opportunity arises. But how does this compare to hourly rebalancing?

While rebalancing every hour might sound sufficient, the reality is that in the fast-moving DeFi space, yield rates can shift dramatically within minutes. Missing even a small window of higher rates can significantly lower your overall annual percentage yield (APY).

In testing, continual rebalancing achieved an impressive average APY of 17.2%, compared to 11.6% for the hourly rebalancing approach. Why the difference?

With hourly rebalancing, if rates drop shortly after a rebalance, you’re stuck earning less until the next rebalance occurs. Continual rebalancing, on the other hand, moves quickly to capture higher yields as soon as they appear, ensuring your assets are always earning at their full potential.

The difference may seem small over short periods, but over months and years, the compounded effect of quicker adjustments leads to significantly higher returns.

Why Carrot Makes this Possible.

Carrot’s innovative approach makes rebalancing fast, efficient, and cost-effective. Unlike other lending aggregators that often operate with siloed accounts, each requiring separate transactions, Carrot pools assets into a large, unified fund. This allows us to rebalance much quicker and burn next to nothing on gas fees. In contrast, managing 10,000+ siloed accounts would lead to significant gas costs that add up over time, eroding returns.

With Carrot’s pooled structure, rebalancing happens with a single, seamless transaction, reducing both transaction fees and the time your assets spend in transition. This ensures that your funds are always optimally positioned, capturing the best yields available.

Here’s how Carrot makes this possible:

Real-time Data Monitoring: Carrot continually analyzes real-time data from multiple DeFi protocols to identify yield opportunities as they arise.

Automated Asset Movement: Our smart contracts swiftly move assets between lending pools in a single transaction, minimizing gas fees and ensuring timely execution.

Optimized Pool Allocation: Carrot’s algorithm efficiently allocates your funds to maximize yield while minimizing risk, so you don’t have to worry about manual adjustments or missed opportunities.

This streamlined process allows Carrot to deliver faster and more cost-effective rebalancing, giving you better performance and lower costs compared to more fragmented approaches.

Conclusion: Carrot – The Key to Higher, Safer Yields

Carrot’s continual rebalancing isn’t just faster; it’s smarter. By automating the process and analyzing the market in real-time, Carrot ensures your assets are always positioned to earn the highest available yield. This continual optimization strategy consistently outperforms traditional hourly rebalancing, delivering stronger APY over time and giving you peace of mind.

The efficiency of Carrot’s single-transaction rebalancing also cuts down on gas fees, so more of your money stays in your pocket. Whether you’re a seasoned DeFi user or just getting started, Carrot’s platform simplifies the complexities of yield farming, allowing you to benefit from the best rates with minimal effort and risk.